🔥 35% OFF ALL ACCOUNTS | USE CODE: SPRING | ENDS 5/31 at 11:59PM EST 🔥

Get a stream of income and unlock your earning potential.

Learn how to manage risk and scale your trading with up to $750,000. Prove you can succeed and earn a Live Trading Account.

Partnered with the best trading platforms

Tradovate and Ninjatrader are industry-leading platforms with powerful features and bank-grade security.

Select your plan

Take the first step and gain practical trading experience.

Can’t find a better prop firm than this!

“I’ve been using Tradeify for several weeks now, and it has genuinely transformed my trading experience. The platform is intuitive, user-friendly, and packed with features that cater to both novice and experienced traders.”

– Casper

$50k Tradeify Challenge

Take the first step to your financial freedom.

$99 per month

Profit target: $3,000

🔻 $2,000 live trailing drawdown

🤝 Max Positions: 5 minis / 5 micros

📅 Trade minimum of 7 days

⏰ Close trades by 4.59 EST

$100k Tradeify Challenge

Take the first step to your financial freedom.

$199 per month

Profit target: $6,000

🔻 $3,000 live trailing drawdown

🤝 Max Positions: 10 minis / 100 micros

📅 Minimum 7 trading days

⏰ Close trades by 4.59 EST

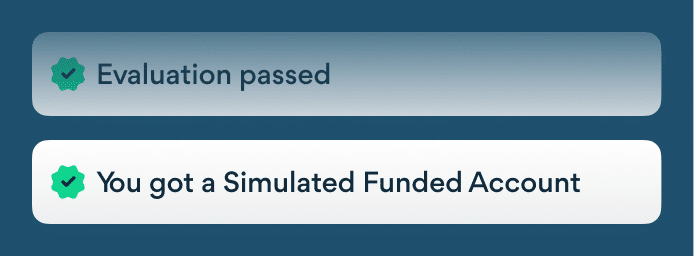

Become a Live Funded Trader in 3 clear steps

Step 1

Pass a Growth or Advanced evaluation, or go Straight to Simulated Funded

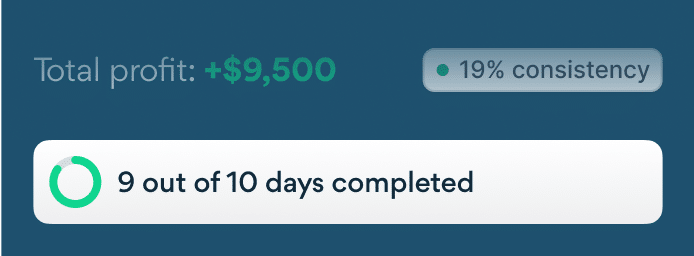

Step 2

Trade consistently and earn 4 payouts on your Simulated Funded Account

Step 3

Earn your Live Funded Account with trading freedom and tons of benefits

Start your day with real-time market insights

Grow faster with daily market insights, practical strategy breakdowns, live Q&As, and more.

Which plan is right for me?

Advanced

The drawdown is calculated continuously throughout the trading day, adjusting in real-time as your account balance fluctuates.

Forces more disciplined trading since losses are tracked immediately. Can protect you from significant losses during the day.

Less flexibility, as intra-day losses can immediately impact your drawdown limit, potentially leading to an earlier account closure if the market moves against your positions.

Growth

The drawdown is calculated based on the highest account balance at the end of the trading day. It only adjusts downward at the end of the day if your account balance has reached a new high.

Offers more flexibility during the trading day. Intra-day fluctuations won’t affect the drawdown level, allowing you to hold positions with less risk of hitting the drawdown limit due to temporary losses.

Slightly higher risk of losing larger amounts by the end of the day if the market moves against you.

Straight to Sim Funded

Get simulated funded instantly with an ‘End of Day’ trailing drawdown and a soft breach ‘Daily loss limit’ to protect you on difficult days.

No need to pass a challenge, get simulated funded instantly and earn payouts with a larger end of day trailing drawdown.

Straight to Sim Funded accounts are built for steady, consistent traders and as a result the consistency rule is set to 20%.

On a mission to make trading accessible to everyone.

$50k, $100k or $150k

Option for Straight to Sim Funded

No complicated rules

Backed by real traders

A game-changer for young entrepreneurs

Trade Futures Contracts in one place.

What you’ll trade:

- Stock Indices

- Currencies

- Metals

- Energies

- Bitcoin

Frequently Asked Questions

What is Tradeify?

At Tradeify, we empower talented traders to generate payouts through a streamlined 3-step process designed to maximize opportunity and minimize personal financial risk. Our program begins with a trading challenge, progresses to a simulated funded stage, and culminates in a live funded account for consistent and successful traders. For those ready to jumpstart their journey, our Straight to Sim Funded program allows users to begin directly at the simulated funded stage. This lets traders start generating profits immediately while proving their consistency. Tradeify provides cutting-edge tools to support your trading journey, including automated journaling to analyze and improve performance, and a dedicated trader support team to guide you every step of the way. Our platform offers a seamless trading experience with transparent rules, disciplined risk management practices, and opportunities to scale to significant capital. With Tradeify, you’re not just trading—you’re leveraging advanced technology and personalized support to build a successful and lasting partnership.

Who is eligible for the challenge?

Tradeify does not accept or permit the participation of individuals or entities who are citizens, residents, or are otherwise located in the following countries:

- Afghanistan

- Albania

- Algeria

- Angola

- Bahamas

- Barbados

- Belarus

- Bosnia & Herzegovina

- Botswana

- Burma (Myanmar)

- Burundi

- Cambodia

- Central African Republic

- Côte d’Ivoire

- Crimea

- Cuba

- Democratic Republic of Congo

- Ecuador

- Ethiopia

- Ghana

- Iceland

- Indonesia

- Iran

- Iraq

- Jamaica

- Kosovo

- Laos

- Lebanon

- Liberia

- Libya

- Mauritius

- Mongolia

- Montenegro

- Nicaragua

- North Korea

- Pakistan

- Panama

- Papua New Guinea

- Russia

- Somalia

- South Sudan

- Sri Lanka

- Sudan

- Syria

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- Ukraine

- Vietnam

- Venezuela

- Yemen

- Zimbabwe

Any individual or entity from these restricted countries is prohibited from accessing Tradeify’s services.

See: Restricted Countries for the full list

What are the different trailing drawdowns?

We invite you to read our full article on Trailing Drawdowns here.

What is a Simulated Funded Account?

A Simulated Funded Account is a type of trading account designed to replicate the conditions of a live trading environment but without using actual capital. When you’re a newly funded trader, transitioning to live trading can be challenging, and a Simulated Funded Account allows you to gain experience and build confidence in a real-time setting. This account lets you continue trading with the same level of intensity as a live account while giving you the opportunity to demonstrate consistency in your trading performance.

How Does it Work?

In a Simulated Funded Account, your trades mirror what would happen in the live markets, but your profits and losses are not real. This setup gives you the chance to practice your strategies and manage risks as if you were trading with real money. The profits you generate in the Simulated Funded Account can still lead to actual payouts, allowing you to earn while you hone your skills.

What’s the Purpose?

The primary goal of the Simulated Funded Account is to provide a buffer period where you can adapt to the psychological and strategic demands of live trading. It helps bridge the gap between being a successful evaluation trader and becoming a consistent performer in live markets.

Monitoring and Evaluation

Throughout your time in the Simulated Funded Account, our risk managers will closely monitor your trading activity. They assess your ability to follow trading rules, manage risk, and maintain consistency. Once you demonstrate that you can trade successfully within the parameters of the Simulated Funded Account, you may be transitioned to a full live trading account where you’ll trade with real capital.

We do not have any rules against or guidelines around trading news events. Free reign, but beware of volatility and how it can affect your account.